How to apply for Tax Exempt status? - Sam's Club

For tax exempt status, please visit the Membership Desk of your local club and provide a copy of state-required tax exemption documents—this can differ by state.

What if I purchased without tax exempt status? - Sam's Club

What if I purchased without tax exempt status? If you have already purchased and aren't registered as tax exempt or didn't select tax exempt while purchasing, you have a couple options.

How do I make my online order tax exempt? - Sam's Club

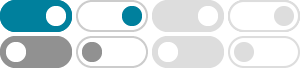

Everyone on a tax exempt Membership can purchase as tax exempt unless blocked by the primary cardholder. For questions about item limits or restrictions, check with your state's …

Find Answers - Sam's Club

For tax exempt status, please visit the Membership Desk of your local club and provide a copy of state-required tax exemption documents—this can differ by state.

Curbside Pickup Overview & FAQ - Sam's Club

To make a tax-exempt purchase for Curbside Pickup, you must be approved for tax exempt status on your membership. If you haven’t been approved, you will not be able to purchase as tax …

Contact Us - Sam's Club

Question? We'd love to hear from you. Send us a message and we'll respond to you soon.

Pickup - Sam's Club

To make a tax-exempt purchase for Curbside Pickup, you must be approved for tax exempt status on your membership. If you haven’t been approved, you will not be able to purchase as tax …

Error

Your browser either does not have JavaScript enabled or does not appear to support enough features of JavaScript to be used well on this site.

Membership Company Cards - Sam's Club

Company Cards accrue Cash Rewards but cannot redeem Cash Rewards. No name on card, only the name of the business. If the Membership is setup as tax exempt, a company card attached …

Do I have to pay taxes on Sam's Club Membership fees?

This is determined by state and local tax regulations. States that collect tax on Sam's Club Membership fees are: Arizona California Hawaii Louisiana Nebraska New Jersey New Mexico …